new jersey tax

Pay Homestead Benefit bills. The flat sales tax rate means you will pay.

|

| No Sales Tax On Clothes Interesting Jersey Girl Jersey God Bless America |

Site Maintained by Division of Revenue and Enterprise Services.

. Your BRC will include a control number used only to verify that. Your New Jersey Tax ID number will be the same as your EIN number plus a 3-digit suffix and is used for state tax purposes. 2019 property taxes were paid on that home. Pay Senior Freeze Property Tax Reimbursement bills.

Ad See If You Qualify For IRS Fresh Start Program. If your notice directs you to choose Option B to make a. New Jersey collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Unlike the Federal Income Tax New Jerseys state income tax does not provide.

If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783. Ad E-File Free Directly to the IRS. Free Case Review Begin Online. There is also a jurisdiction that collects local income taxes.

The State of NJ site may contain optional links information services andor content from other websites operated by third parties that are. 1 2018 that rate decreased from 6875 to 6625. E-File Directly to the IRS State. The rate of sales tax in New Jersey is 6625 percent ranking eighth in the country according to the Tax Foundation.

New Jersey Sales Tax. New Jersey has a 65 percent to 115 percent corporate income tax rate. Division of Taxation PO Box 281 Trenton NJ 08695-0281. New Jersey Income Tax Calculator 2021.

Free 2021 Federal Tax Return. If you were not a homeowner on October 1 2019 you are not. Your 2019 New Jersey Gross Income was 250000 or less. New Jersey state income tax rate table for the 2022 - 2023 filing season has seven or eight income tax brackets with NJ tax rates of 14 175 245 35 5525 637.

New Jersey has a single statewide sales tax rate. State of New Jersey Government NJ Taxes. Based On Circumstances You May Already Qualify For Tax Relief. New Jersey sales tax rate.

New Jersey has a 6625 percent state sales tax rate a max. E-File Directly to New Jersey for only 1499. Your average tax rate is 1198 and your marginal tax. Ad See How Long It Could Take Your 2021 State Tax Refund.

|

| States With The Highest And Lowest Property Taxes Property Tax Tax States |

|

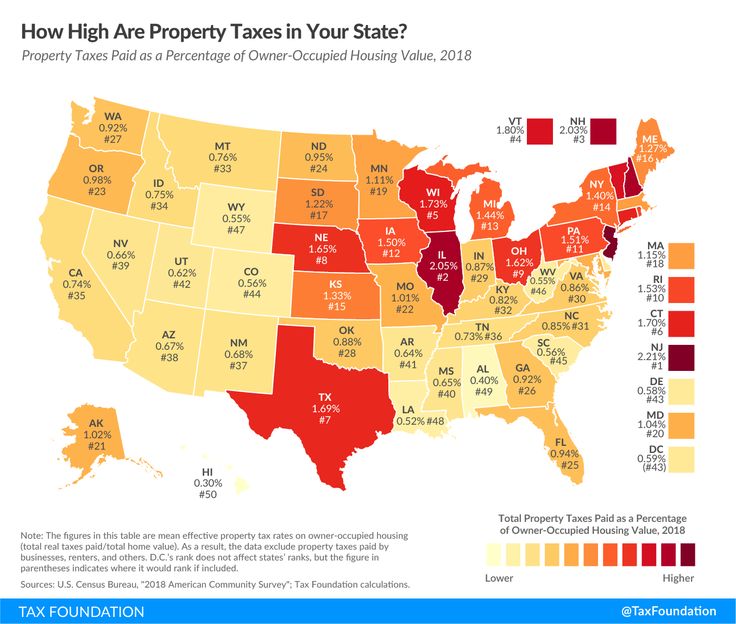

| New Jersey Has The Highest Effective Rate On Owner Occupied Property At 2 21 Percent Followed Closely By Illinois 2 05 Percent And N Property Tax Tax States |

|

| Myustaxreturn Financial Taxation Services In New Jersey Area Financial Statement Analysis Jersey City Filing Taxes |

|

| States With The Lowest Corporate Income Tax Rates Infographic Infographic History Geography Best Places To Move |

|

| New Jersey State Income Tax Form Tax Forms Post Office Income Tax |

Posting Komentar untuk "new jersey tax"